https://www.cnbc.com/2024/10/03/ports-strike-chaos-costs-starting-to-rise.htm

The ongoing strike at East and Gulf Coast ports has reached its third day, severely disrupting the U.S. logistics system. Thousands of containers have been misplaced, and transportation costs are soaring as cargo is diverted to alternative ports. With no resolution in sight, the strike threatens to further impact supply chains, retailers, and consumers.

▶ Supply Chain Chaos: “East & Gulf coast ports strike enters day 3, causing widespread container misplacements, surging logistics costs, and billions in delayed trade.

▶ Soaring Transportation Costs: “Ocean carrier surcharges & inland trucking costs skyrocket as containers are rerouted to unintended ports—some truck trips now cost 6x more.

▶ Major Consumer Impact: “Grocers brace for shortages, while shipping delays lead to price hikes on fresh produce, fish, and even medical supplies.

Logistics Bottlenecks: “Ships rerouting to ports like the Bahamas & Canada as East Coast docks remain closed, adding pressure on trucking and rail systems.

▶ $2 Billion Daily Economic Hit: “If the strike continues, the U.S. economy could lose $2B per day, impacting retailers like Amazon, Walmart, and Home Depot.

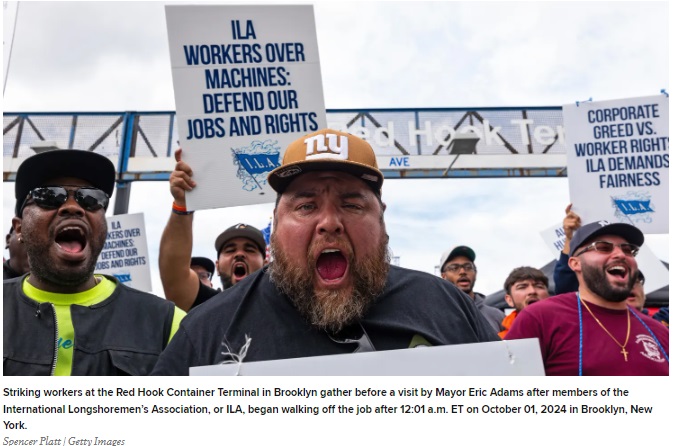

The potential strike by the International Longshoremen’s Association (ILA) and the broader tensions between labor unions and port operators raise significant concerns for both the U.S. economy, particularly trucking services, freight transportation, and the global supply chain. With no resolution in sight over wage increases and port automation, the situation reflects deep-rooted friction between unions striving to protect jobs in industries such as truckload shipping (TL), less-than-truckload (LTL) shipping, and freight logistics services, and operators looking to implement technological advances to enhance efficiency in areas like fleet management software and transportation management systems (TMS).

Automation is a particularly contentious issue in both the freight carriers and trucking industries. While it promises increased productivity and long-term cost reductions for port operators and freight shipping rates, it also threatens traditional jobs in areas such as flatbed trucking, reefer trucking (refrigerated transport), and drayage services, fueling fears within the workforce. The ILA’s opposition is understandable, given the potential for job losses or role changes in jobs like hazmat transportation or intermodal transportation. On the flip side, port operators argue that technological advancements, such as logistics tracking solutions, are inevitable and necessary for remaining competitive in the global market.

If a strike or lockout occurs, the economic impact would be severe, even if it lasts only a short time. The East and Gulf Coast ports handle a significant volume of trade, impacting long haul trucking, expedited shipping, and cross-border services like US-Mexico transportation. Any disruption would ripple across industries, potentially exacerbating inflation and freight cost per mile, creating shipping cost per mile hikes, and supply shortages, as seen during the West Coast ILWU disruptions last year.

A broader concern is how the White House would react, especially during an election year. The Biden administration, known for its pro-labor stance, is caught between supporting workers’ rights, which could affect industries like dedicated freight services and cross-border trucking (US, Canada, Mexico), and avoiding the economic chaos that a prolonged port shutdown would cause, affecting nationwide freight shipping and local trucking services. The administration might be reluctant to intervene quickly using the Taft-Hartley Act, but the need to balance these interests will likely push them to ensure any strike is short-lived. Still, even forced resolutions could result in long-term disruptions through tactics like intentional slowdowns, which could impact reliable freight services and increase freight shipping rates.

Overall, this situation underscores the complex dynamics at play between labor, automation, and economic stability. The outcome of these negotiations will likely set precedents for how automation is introduced across industries, particularly green freight solutions, moving forward. It could either strengthen labor’s hand in safeguarding jobs or accelerate the adoption of automation, affecting sectors like electric trucks and sustainable trucking, in ways that limit union influence.

https://www.cnbc.com/2024/10/03/ports-strike-chaos-costs-starting-to-rise.htm